Casablanca – Zilla Capital, an Egyptian investment banking and asset management group, is preparing to enter the Moroccan market in the second half of 2026 as part of a broader regional expansion strategy across Africa and the Middle East. The move reflects growing international interest in Morocco’s financial sector and its role as a regional investment hub, supported by market recovery, large infrastructure projects, and rising capital market activity.

Founded in 2018 in Egypt, Zilla Capital has established itself as a significant regional player in financial advisory and asset management. The group operates across several core segments, including mergers and acquisitions advisory, capital raising, IPOs, corporate restructurings, and the structuring of financial products. Its track record includes transactions in Egypt, the United Arab Emirates, and Kenya, positioning the firm as an active participant in cross-border financial activity within emerging markets.

According to the group’s leadership, Morocco has been identified as a strategic destination within this regional expansion plan. The firm intends to pursue a gradual market entry, beginning with financial advisory services. This approach is designed to build a solid local presence before expanding into other business lines, in line with market demand and regulatory developments. The objective is to support Moroccan companies in navigating capital markets, managing corporate restructuring, and developing growth strategies in an increasingly competitive and dynamic economic environment.

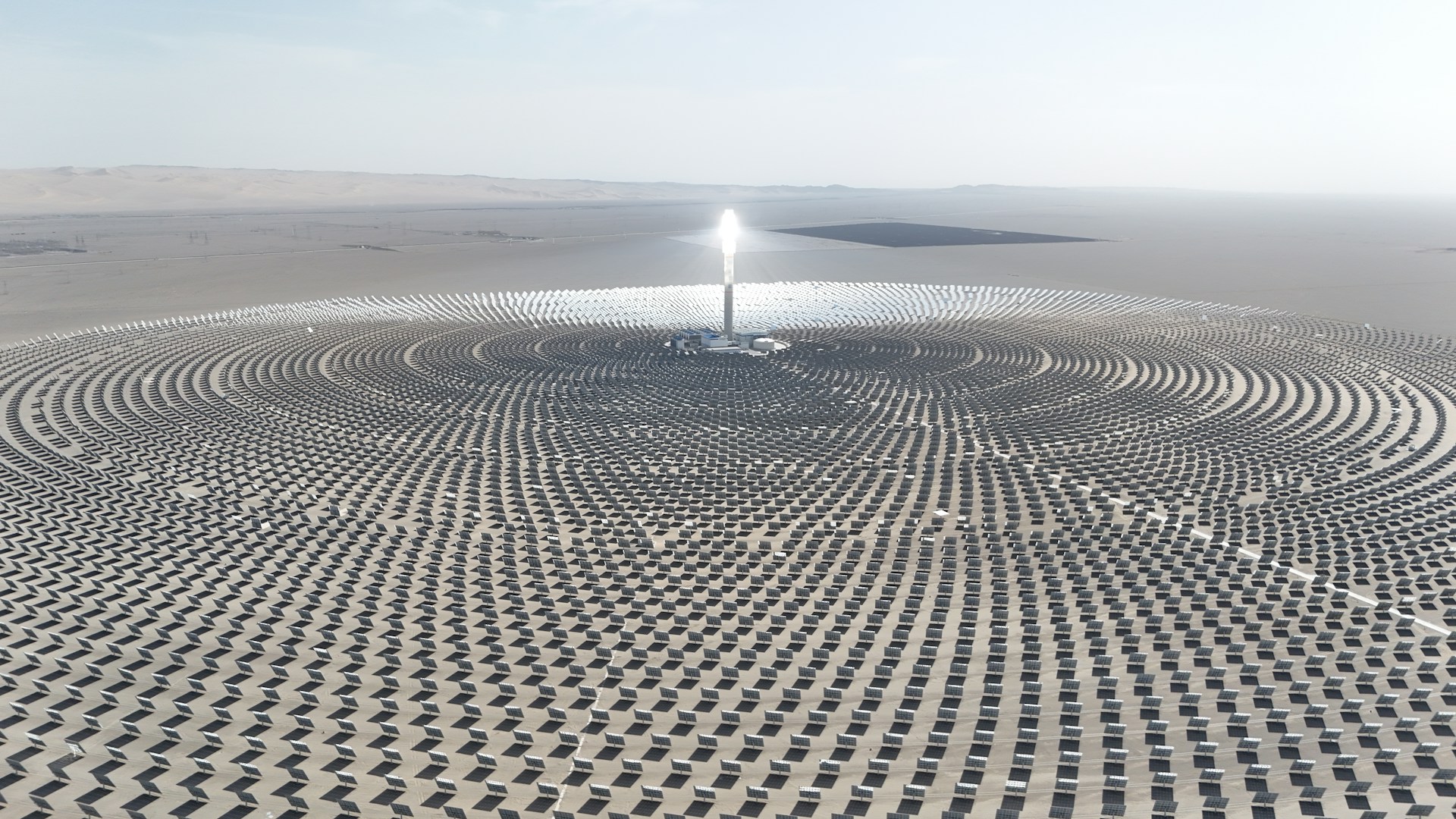

The timing of Zilla Capital’s planned entry aligns with renewed momentum in Morocco’s financial markets. After a period of relative slowdown, the Moroccan stock exchange has seen a return of IPO activity, signaling growing confidence among issuers and investors. This revival is occurring alongside a broader economic context marked by large-scale public and private investment programs, particularly in infrastructure, energy, transport, and tourism.

A key driver of this investment cycle is Morocco’s preparation for co-hosting the 2030 FIFA World Cup. The event is expected to accelerate infrastructure development, including transport networks, urban regeneration projects, hospitality capacity, and digital infrastructure. These projects are generating significant financing needs and creating opportunities for advisory services across project finance, capital markets, and corporate transactions. Financial institutions and advisory firms are positioning themselves to support these initiatives, which are viewed as both economically transformative and strategically important for the country’s long-term development.

Zilla Capital’s management has highlighted that Morocco is increasingly attracting the attention of regional and international investors. This interest is driven not only by infrastructure projects but also by broader structural reforms, improving market depth, and efforts to modernize the financial system. The group sees these trends as creating favorable conditions for establishing a long-term presence and contributing to the development of local capital markets.

While Morocco represents a central pillar of Zilla Capital’s expansion strategy, the group is also pursuing growth in other key regional markets. In parallel with its Moroccan plans, Zilla Capital is working to secure regulatory approvals to launch operations in Saudi Arabia, with licenses expected by the end of the first quarter of 2026. Saudi Arabia is considered a strategic market, particularly in the debt capital markets segment, given the scale of its sovereign and corporate financing needs, as well as ongoing economic diversification efforts.

This multi-country expansion reflects a broader strategy focused on high-potential markets and high-value-added segments. Rather than pursuing rapid, large-scale rollouts, Zilla Capital is adopting a measured approach, prioritizing regulatory compliance, local partnerships, and the development of tailored financial solutions aligned with each market’s specific characteristics.

In Morocco, the firm’s initial focus on advisory services is expected to cover areas such as capital market transactions, corporate restructurings, strategic advisory, and growth planning. Over time, the scope of activities could expand to include asset management, structured finance, and other investment banking services, depending on market conditions and regulatory frameworks.

The group’s expansion also comes at a time when Moroccan companies are increasingly seeking sophisticated financial advisory support. Many firms are pursuing regional and international expansion, corporate consolidation, or restructuring in response to evolving competitive pressures and macroeconomic conditions. At the same time, public and private sector entities are engaging in complex financing arrangements to support infrastructure and development projects, further increasing demand for specialized advisory expertise.

Zilla Capital’s leadership has emphasized its intention to contribute to the local financial ecosystem by transferring expertise, building local teams, and supporting the professionalization of financial advisory services. This aligns with broader national objectives to deepen Morocco’s capital markets, diversify financing sources, and enhance the role of the private sector in economic growth.

Since its establishment, Zilla Capital has built a reputation for working on transactions across a range of sectors, including financial services, real estate, energy, infrastructure, healthcare, and technology. Its experience in IPOs, mergers and acquisitions, and financial structuring positions it to participate in some of the more complex transactions expected to emerge in Morocco over the coming years.

The group’s expansion into Morocco also reflects a wider trend of increased South-South investment flows and regional integration within Africa and the Middle East. Financial institutions from emerging markets are increasingly seeking growth opportunities in neighboring regions, leveraging cultural, economic, and regulatory similarities while responding to rising demand for capital market services.

As Morocco continues to position itself as a financial and investment gateway between Africa, Europe, and the Middle East, the entry of new international and regional financial institutions is likely to intensify competition, enhance service quality, and broaden the range of financial products available to local companies and investors. This, in turn, could contribute to deeper capital markets, improved corporate governance standards, and greater access to financing.

Zilla Capital’s planned market entry in the second half of 2026 will be closely watched by market participants, particularly as it coincides with a period of heightened investment activity and structural transformation in the Moroccan economy. If executed as outlined, the move could strengthen the country’s investment banking landscape and reinforce its role as a regional financial hub.

Zilla Capital’s expansion into Morocco reflects both the group’s regional growth ambitions and Morocco’s evolving position in regional and global financial markets. Through a phased entry strategy focused initially on advisory services, the firm aims to establish a durable presence, support local corporate and market development, and participate in the financing and advisory opportunities generated by Morocco’s next phase of economic growth.