Casablanca – On October 1, 2024, Standard & Poor’s (S&P) announced that it has maintained Morocco’s sovereign debt rating at BB+/B, with a “positive” outlook, despite slight adjustments to its economic forecasts. This decision comes as the Moroccan government continues its efforts to attain the coveted “Investment Grade,” which remains elusive.

In its latest report, S&P slightly revised its GDP growth forecast for Morocco to 3.1% for 2024, down from an earlier projection of 3.4%. This adjustment is primarily attributed to a lackluster agricultural season, further complicated by ongoing water shortages. The agency noted, “We believe that the water scarcity will likely continue to hinder agricultural output in the coming years.” While Morocco’s economy is diversifying, it still heavily relies on rain-fed agriculture, making it particularly vulnerable to fluctuations in weather patterns.

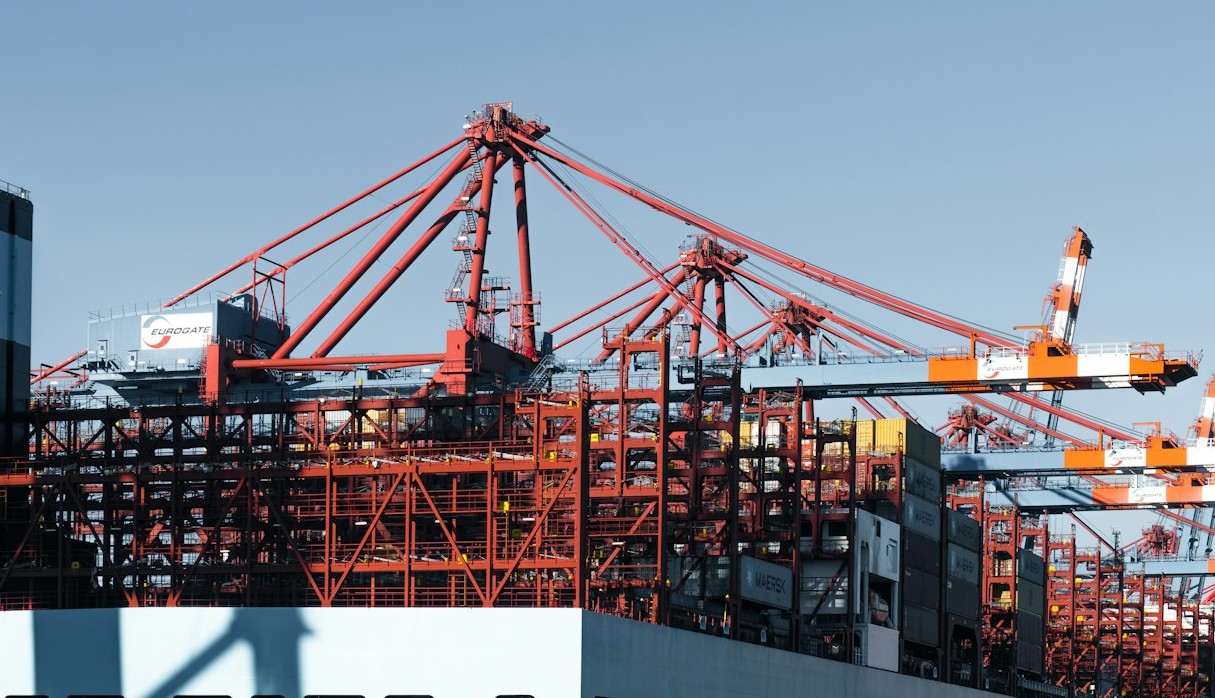

Despite the challenges in the agricultural sector, S&P acknowledged the strengthening performance of Morocco’s tourism, phosphate, automotive, and aerospace industries, which are expected to bolster growth and economic stability in the long term. Economic growth reached 3.4% in 2023, slightly exceeding earlier expectations, thanks to a series of reforms aimed at prioritizing investments in water and energy, as well as modernizing the legal and regulatory frameworks.

The agency forecasted a gradual reduction in Morocco’s budget deficit, projecting it to decrease from 4.4% of GDP in 2023 to 4.2% in 2024, with a target of approximately 3% by 2027. This positive trajectory is supported by the government’s decision to begin phasing out subsidies on butane, wheat, and sugar, which is expected to free up resources for expanding social protection coverage.

S&P views the current outlook as a reflection of Morocco’s potential to build on recent economic achievements and implement necessary socio-economic reforms, setting the stage for inclusive growth and fiscal consolidation. However, the agency cautioned that the positive outlook could be revised to “stable” if economic growth, budget consolidation, or reform momentum does not meet expectations over the next year.

Regarding public debt, S&P projects it will remain around 65% of GDP through 2027, a level consistent with current estimates. The risk of refinancing and currency fluctuations appears manageable for Morocco, further supporting its fiscal position.

In terms of the current account, the agency anticipates improvements over the 2024-2027 period, forecasting savings of 1.6% of GDP, driven by stronger domestic demand. Tourist revenues have already shown a 3.3% increase in the first seven months of 2024 compared to the same period in 2023, while automotive exports rose by 9%.

On the energy front, Morocco has seen a 5.2% decline in its energy bill, which is significant given that the country imports over 90% of its energy needs. S&P pointed out that Morocco largely finances its current account through foreign direct investment (FDI) inflows and external borrowing, with expectations for gradual increases in FDI in the coming years.

Overall, S&P’s report underscores the importance of continued reforms and proactive measures in maintaining Morocco’s economic stability and attractiveness for investment. The agency remains optimistic about Morocco’s ability to leverage its strengths while addressing existing vulnerabilities.