Casablanca – OCP Group, Morocco’s phosphate giant, recorded a significant increase in its financial performance during the first nine months of 2025, reflecting sustained global demand for phosphate fertilizers and a strong export strategy. Consolidated revenues reached $8.69 billion by the end of September, up 22% compared to the same period in 2024.

Despite mixed conditions in international markets, global fertilizer prices began the third quarter on an upward trend before stabilizing in mid-August. Demand for phosphates remained higher than the previous year, driven primarily by India — benefiting from supportive government policies and low stock levels — as well as by Brazil, Bangladesh, and several African countries, including Ethiopia, which played a key role in the overall growth. By contrast, demand in the United States weakened due to challenging economic conditions for farmers.

Strong net profit highlights operational efficiency

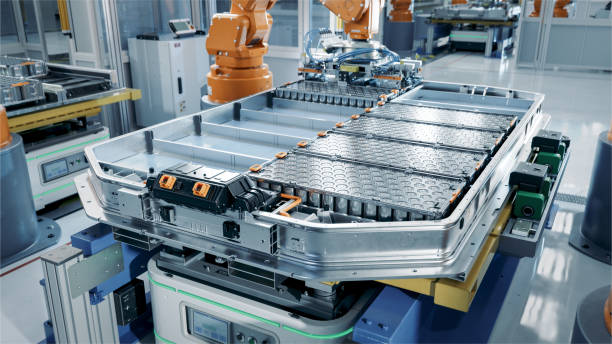

OCP reported a consolidated net profit of $0.89 billion by mid-2025, representing a 5% increase compared to the same period last year. This performance underscores the resilience of the Group’s integrated model, which combines mining, processing, logistics, and innovation to manage global market fluctuations effectively.

Export growth and strategic realignment drive revenue

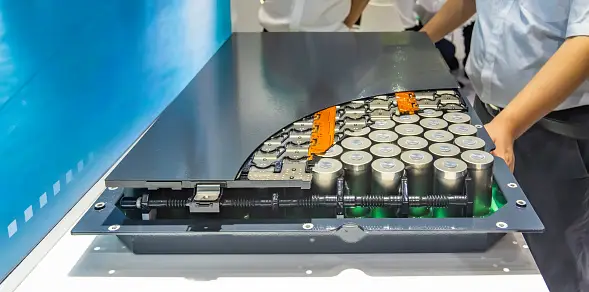

A major driver of revenue growth was the increase in export volumes. Phosphate fertilizer sales grew by 17% in local currency terms, with triple superphosphate (TSP) sales surging 55%, now accounting for 30% of the Group’s fertilizer exports. TSP remains particularly strong in India, Brazil, and African markets. Phosphate rock exports increased by 112%, highlighting OCP’s strengthened role as a global supplier.

Meanwhile, phosphoric acid revenues declined by 10% as the Group strategically shifted production toward higher value-added products. This adjustment aligns with OCP’s long-term strategy to increase competitiveness and move up the value chain.

Specialty products reinforce growth strategy

The Specialty Products & Solutions (SPS) division maintained strong momentum, generating $0.63 billion in export revenues over the first nine months of 2025. This growth was driven by specialized acids, water-soluble fertilizers, and phosphates for animal nutrition. SPS is emerging as a structural growth driver within the Group, reinforcing OCP’s focus on innovation and product differentiation in a changing global agricultural market.

Robust financial fundamentals

OCP’s gross margin rose to $5.53 billion, up from $4.59 billion a year earlier, reflecting a combination of favorable price and volume effects alongside efficient cost management, despite rising input prices such as ammonia and sulfur. EBITDA reached $3.20 billion by September 2025, compared to $2.78 billion a year earlier, marking a 15% increase, with an EBITDA margin of 37%. These results demonstrate the strength of OCP’s operational model and industrial efficiency.

Strategic significance for Morocco

Beyond financial performance, OCP continues to be a strategic pillar for Morocco’s economy. Its operations not only contribute significantly to exports but also drive regional development through employment, infrastructure, and territorial investments. The shift toward higher-value production, international expansion of agricultural solutions, and technological innovation strengthens Morocco’s position in global food security.

Looking ahead, OCP’s challenge will be to sustain industrial performance while integrating environmental sustainability and regional development objectives, ensuring that its growth remains both profitable and strategically aligned with global agricultural trends.