Casablanca – Morocco is accelerating its ambition to become a regional leader in the railway industry by 2040, supported by large-scale public investment and growing industrial activity from global players such as Alstom. Recent developments point to a coordinated strategy that combines infrastructure expansion, industrial localization, job creation, and export-oriented manufacturing.

At the industrial level, Alstom recently inaugurated the world’s first production line dedicated to train driver control desks at its site in Fes. The project represents an investment of approximately $10.31 million and marks a new phase in the company’s growing footprint in Morocco. The Fes facility, which initially began operations in 2020 producing wiring harnesses and electrical cabinets, has steadily expanded its capabilities. In 2022, transformer manufacturing was added, and the new control desk line now positions the site as a strategic component of Alstom’s global supply chain.

Alstom has significantly expanded its operations in Morocco in recent years, with its workforce rising from around 500 to over 1,400 employees, nearly 60% of whom are women. The company expects its staff to surpass 1,600 within the next two to three years, driven by the creation of more than 200 new direct jobs tied to expanded production. Hiring efforts are centered on engineers, technicians, and qualified operators, supported by in-house training programs aimed at building local skills.

Since 2019, Alstom has invested more than $17.73 million in Morocco, bringing total investment since 2020 to approximately $27.84 million. This positions Morocco among the company’s most significant industrial locations in Africa, the Middle East, and Central Asia, second only to South Africa within the region. Alongside the control desk line, Alstom is doubling its production capacity for Mitrac transformers and opening a new engineering and design office, reinforcing the country’s role as a manufacturing and innovation hub.

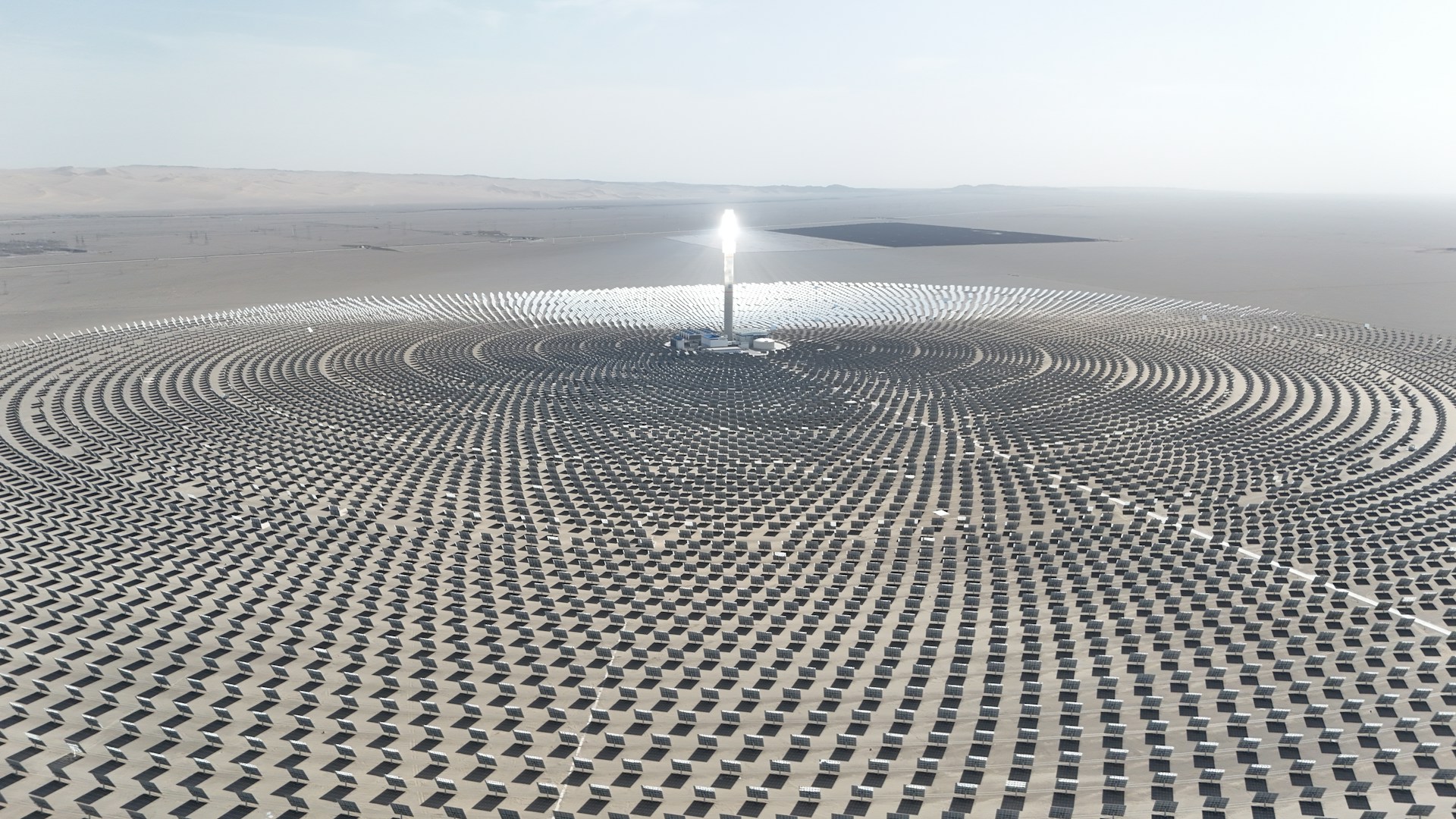

These industrial developments align closely with Morocco’s broader national rail strategy. The government has announced a long-term plan valued at approximately $41.24 billion to modernize and expand the national railway network by 2040. The plan aims to strengthen domestic connectivity, promote sustainable mobility, and establish Morocco as a leading exporter of rail equipment to European and African markets.

A central component of this strategy is the expansion of high-speed rail. New lines are planned to connect major cities at speeds ranging from 220 to 320 kilometers per hour. Additional conventional lines, with maximum speeds of up to 160 kilometers per hour, will extend service to regions currently outside the national rail network. By 2040, Morocco aims to connect 43 cities, compared with 23 today, increasing coverage to approximately 87% of the population.

The plan also includes integrating transport infrastructure across sectors. By 2040, the rail network is expected to connect 12 ports and 15 airports, improving logistics efficiency, facilitating trade flows, and enhancing Morocco’s role as a gateway between Europe, Africa, and the Middle East. These linkages are seen as critical to strengthening the country’s competitiveness in global supply chains.

Station infrastructure is another priority. Approximately $1.44 billion has been allocated for the construction and rehabilitation of 40 railway stations nationwide. These upgrades are intended to improve passenger experience, increase capacity, and support the anticipated growth in rail traffic resulting from network expansion.

In the medium term, expected investments in rail infrastructure are projected to reach approximately $9.90 billion by 2030. Of this amount, about $5.46 billion is earmarked for developing the high-speed rail line between Kenitra and Marrakech, while the remainder will support station modernization and network upgrades. These investments are expected to create around 300,000 direct and indirect jobs, contributing to workforce development and regional economic growth.

A key pillar of Morocco’s strategy is industrial localization. The government plans to establish a domestic train manufacturing unit to reduce reliance on imports and build a national ecosystem integrating local suppliers, contractors, and service providers. This approach aims not only to meet domestic demand but also to support exports of train cars and rail components to European and African markets.

Alstom’s activities in Morocco illustrate this industrial transition. The Fes site has already supplied components to more than 30 international rail programs, including metro projects in cities such as Lille, Lyon, Turin, Dubai, and Riyadh. The new control desk production line is described as “multiplatform,” meaning it can equip a wide range of rolling stock, from high-speed trains to urban transit vehicles. While specific projects remain confidential, the company has confirmed that these components will be installed on trains operating worldwide, further reinforcing Morocco’s export credentials.

The local economic impact of these developments extends beyond direct employment. Approximately 95% of suppliers involved in the construction of the Fes site were Moroccan, and Alstom currently works with 77 local partners. As production scales up, further localization of sourcing is expected, creating additional opportunities for domestic firms across engineering, manufacturing, logistics, and maintenance services.

From a policy perspective, Morocco’s rail strategy is aligned with broader national goals related to sustainable mobility, industrial upgrading, and economic diversification. Rail transport is seen as a key enabler of low-carbon growth, offering a more energy-efficient alternative to road and air transport for both passengers and freight. By investing in high-speed rail, urban transit, and manufacturing capabilities, Morocco aims to support its climate commitments while strengthening industrial competitiveness.

The convergence of public infrastructure investment and private industrial expansion suggests a long-term transformation of Morocco’s rail sector. The combination of large-scale network development, station modernization, industrial localization, and export-oriented manufacturing positions the country to play a leading role in regional rail markets.

As production ramps up and new rail projects move from planning to implementation, Morocco’s railway sector is expected to become a central pillar of national development. The synergy between government strategy and corporate investment, exemplified by Alstom’s growing footprint, reflects a broader shift toward building a resilient, competitive, and export-capable rail industry that serves both domestic needs and international markets.