Casablanca – Morocco has taken a significant step in strengthening its industrial base with the launch of Africa’s largest tire manufacturing complex in the Eastern Region. The project, led by the Chinese group Shandong Yongsheng Rubber through its local subsidiary Goldensun Tire Morocco, marks a major turning point for the region’s economic positioning and reflects growing international confidence in Morocco as a manufacturing and export platform.

The new industrial complex is being developed in the industrial acceleration zone of Betoya, located in Driouch province, near the strategic port of Nador West Med. The total investment is estimated at approximately $690 million, making it one of the largest industrial projects ever undertaken in eastern Morocco. Construction has officially begun, with completion expected in early 2027.

Once fully operational, the facility is expected to reach an annual production capacity of 18 million tires, serving markets across Europe, Africa, the Middle East, and the Americas. The project is also projected to create around 1,737 direct jobs, in addition to hundreds of indirect jobs linked to construction, logistics, maintenance, subcontracting, and related services. This employment impact is expected to contribute significantly to local economic development and income generation in the surrounding areas.

Strategic location and export orientation

The selection of Betoya in Driouch province was strongly influenced by its proximity to Nador West Med, a deep-water port designed to serve as a major logistics and industrial gateway for the Mediterranean region. The port offers direct maritime connections to European and African markets and is positioned as a key hub for transcontinental trade.

By locating the factory near this port, the project is expected to reduce logistics costs, shorten delivery times, and enhance the competitiveness of Moroccan-made tires in international markets. Industry analysts note that this logistical advantage is particularly important for a product such as tires, where transport efficiency and supply chain reliability play a critical role in market access and profitability.

Strengthening Morocco’s automotive ecosystem

The tire manufacturing complex is also strategically aligned with Morocco’s broader automotive and industrial development strategy. Over the past decade, Morocco has built a strong automotive manufacturing base, becoming one of the leading vehicle exporters in Africa and the Mediterranean region. However, tire production had remained absent from the domestic industrial landscape despite the sector’s overall growth.

The launch of this project addresses that gap by integrating tire manufacturing into the national automotive value chain. This is expected to increase local content, reduce reliance on imported components, and strengthen Morocco’s position as a fully integrated automotive production hub. The project also supports the country’s broader goals of industrial upgrading, diversification, and technological advancement.

Technology transfer and research capacity

Beyond production volumes and employment, the project includes a strong focus on innovation and skills development. The industrial complex will incorporate research and development (R&D) centers dedicated to industrial research, product testing, and process optimization. These facilities are expected to support technology transfer, foster innovation, and enhance the technical capabilities of Morocco’s industrial workforce.

The integration of R&D functions is viewed as a key element in Morocco’s efforts to move up the industrial value chain and attract higher value-added investments. It also aligns with national objectives to promote knowledge-based industries and improve the quality and competitiveness of domestic manufacturing.

Workforce development and training

Workforce availability and skills development played a decisive role in the location of the project. Chinese delegations conducted multiple visits to vocational training centers and the City of Trades and Skills in the Eastern Region to assess the quality and relevance of training programs. These assessments focused on the region’s ability to supply qualified technicians, engineers, and skilled workers capable of meeting the technical requirements of tire manufacturing.

The positive evaluation of the local training ecosystem contributed to the company’s decision to choose the Eastern Region over other industrial hubs, including Kenitra, which had initially been considered as a potential site. This highlights the growing importance of human capital and vocational training infrastructure in investment location decisions.

Regional development and territorial balance

The establishment of such a large-scale industrial project in the Eastern Region reflects Morocco’s broader policy objective of promoting more balanced territorial development. Historically, industrial investment has been concentrated in the northern and northwestern corridors, particularly around Tangier, Kenitra, and Casablanca. The Betoya project represents a significant shift toward the east, supporting regional equity and reducing spatial disparities in industrial activity.

Regional authorities view the project as a cornerstone for transforming the Eastern Region into a competitive industrial hub integrated into global value chains. The project is expected to stimulate the development of complementary industries, logistics services, supplier networks, and business services, creating a broader industrial ecosystem around the tire manufacturing complex.

Growing Chinese investment presence

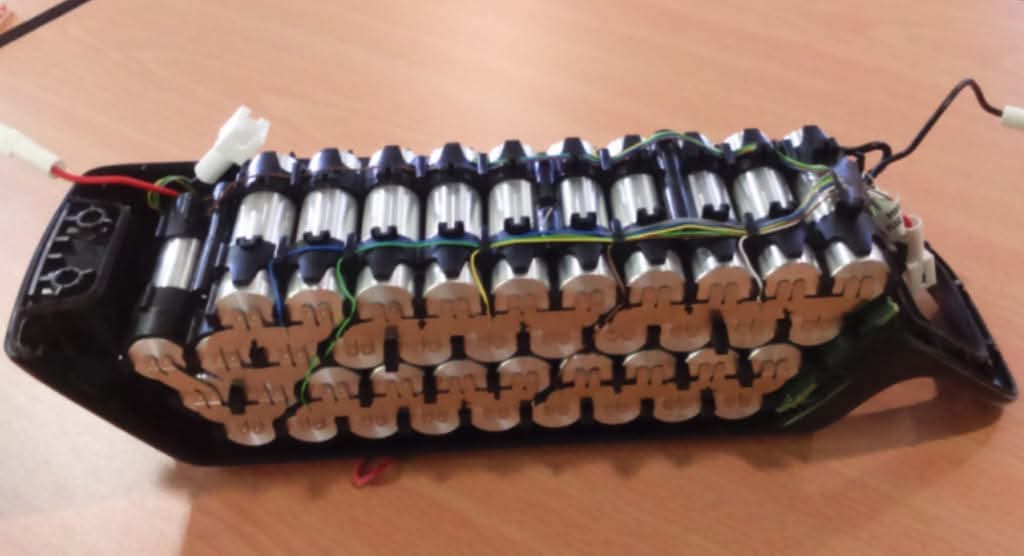

The Betoya project also reflects the expanding presence of Chinese industrial investment in Morocco. In recent years, Chinese companies have increased their involvement across sectors such as automotive components, electric vehicle batteries, renewable energy, advanced materials, and industrial equipment.

Shandong Yongsheng Rubber, founded in 1986, is among China’s leading tire manufacturers, with global brands marketed in more than 80 countries. Its decision to establish a large-scale production facility in Morocco underscores the country’s attractiveness as a manufacturing base offering political stability, competitive labor costs, modern infrastructure, and preferential access to key markets through free trade agreements.

Morocco’s trade agreements with the United States, the European Union, and several African countries provide manufacturers operating in the country with tariff advantages and improved market access. These trade conditions, combined with improvements in the business climate and investment framework, have strengthened Morocco’s position as a gateway for exports to multiple regions.

Long-term economic impact

The long-term impact of the project extends beyond immediate job creation and export growth. By anchoring a major industrial player in the Eastern Region, the project is expected to contribute to sustained industrial diversification, regional economic resilience, and the development of local supply chains. It also reinforces Morocco’s industrial sovereignty by expanding domestic production capabilities in a strategic segment of the automotive industry.

As construction progresses toward completion in early 2027, the Betoya tire manufacturing complex is poised to become a flagship example of Morocco’s industrial transformation and regional development strategy. Its scale, technological orientation, and export focus position it as a major driver of economic growth in the Eastern Region and a symbol of Morocco’s evolving role in global manufacturing networks.