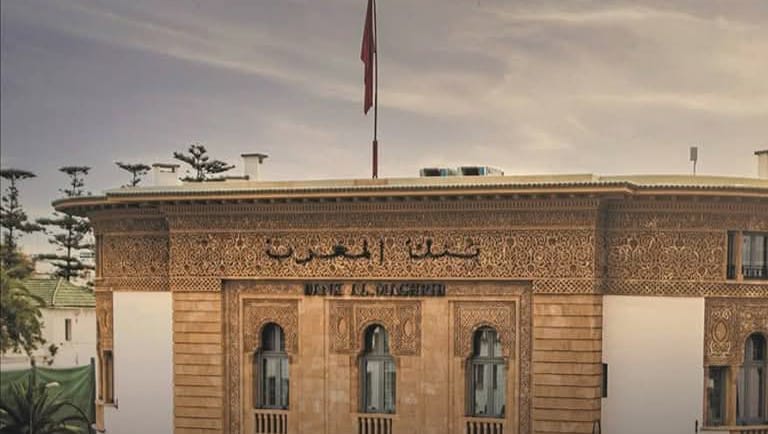

Casablanca – In its third quarterly meeting of 2024, Bank Al-Maghrib (the Central Bank of Morocco) has decided to keep the key interest rate unchanged at 2.75%, stating that the current monetary policy stance remains appropriate given the ongoing economic and social conditions. The central bank continues to closely monitor economic developments while maintaining its cautious approach.

Inflation outlook

Inflation has eased since the start of the year, largely due to a reduction in volatile food prices. After peaking at 5.6% in 2023, core inflation has stabilized around 2%, and projections suggest it will remain near this level for the next two years.

Taking into account changes in subsidies for essential goods and assuming limited volatility in food prices, overall inflation is expected to slow down from 6.1% in 2023 to 1.3% in 2024. However, inflation could rise again to 2.5% in 2025, influenced by potential global economic shifts and energy price fluctuations.

Economic growth projections

Morocco’s economic growth is projected to decelerate after reaching 3.4% in 2023. The economy is expected to slow to 2.8% in 2024 before rebounding to 4.4% in 2025. A key factor behind the slowdown is the 6.9% contraction in agricultural output in 2024, driven by drought and other unfavorable conditions. However, agricultural activity is anticipated to recover with an 8.6% growth in 2025, assuming an average cereal harvest of 55 million quintals.

In contrast, non-agricultural sectors are expected to remain resilient. Growth in manufacturing, extractive industries, and tourism is forecast to continue improving, with non-agricultural growth expected to increase from 3.6% in 2023 to 3.9% in both 2024 and 2025.

Trade and external accounts

Morocco’s trade balance is set to recover after a decline in 2023. Exports are forecast to grow by 4.8% in 2024 and 9.2% in 2025, supported by strong performance in the automotive sector and phosphate sales. By 2025, automotive exports are expected to reach $19.3 billion, while phosphate and derivatives could generate over $9.3 billion in revenue.

Imports, which fell by 2.9% in 2023, are expected to increase by 5% in 2024 and 9% in 2025, driven largely by capital goods purchases. Despite a 2.8% reduction in the energy bill in 2024, it is projected to rise by 4.5% in 2025, reaching $12.8 billion.

Foreign reserves and fiscal deficit

The country’s foreign exchange reserves are projected to continue growing, thanks to robust performance in key sectors like tourism and steady remittances from Moroccans abroad. Foreign reserves are expected to reach $39.6 billion by the end of 2024, providing coverage for around five and a half months of imports. By 2025, reserves are projected to increase to $41 billion.

The fiscal deficit, currently at 4.4% of GDP, is expected to narrow to 3.9% by 2025, supported by increased tax revenues and controlled spending.

Bank Al-Maghrib’s decision to maintain the interest rate at 2.75% reflects a careful approach to monetary policy amid moderate inflation and balanced growth forecasts. The bank remains vigilant in its observation of both domestic and global economic conditions, particularly given uncertainties such as conflicts in Ukraine and the Middle East, which continue to affect energy prices and international trade dynamics.