Casablanca – Morocco is increasingly attracting international attention in the global race for critical minerals, and Australian mining company Zeus Resources Limited (ASX: ZEU) is positioning itself at the forefront of this trend. The company recently signed a strategic five-year licensing agreement with Newmont Venture Limited, a subsidiary of U.S.-based mining giant Newmont Corporation, granting exclusive access to a comprehensive geological database covering Morocco’s Anti-Atlas and Central Meseta regions.

Unlocking decades of geological knowledge

The partnership gives Zeus immediate access to Newmont’s extensive collection of geological, geochemical, and structural datasets. These archives reflect years of systematic exploration in areas recognized for their rich deposits of gold, base metals, and critical minerals, including antimony, which has been classified as a strategic resource by the European Union, the United States, Japan, and Australia.

Hugh Pilgrim, Executive Director of Zeus, emphasized the strategic advantage of the agreement:

“This acquisition positions the company to rapidly assess prospectivity, generate high-quality targets, and focus our efforts on areas with the greatest potential for discovery. The Newmont data provides a competitive edge, enabling more targeted exploration and efficient allocation of resources.”

By leveraging Newmont’s legacy data, Zeus aims to streamline exploration timelines, reduce early-stage risks, and move more swiftly from evaluation to fieldwork and asset acquisition.

Focus on antimony: A critical global resource

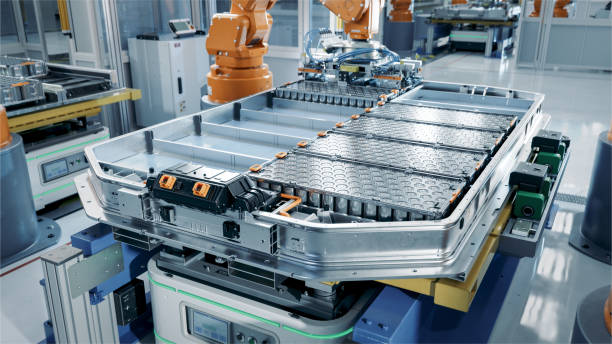

At the core of Zeus’s Moroccan strategy is antimony, a mineral of growing global importance. Antimony is widely used in batteries, electronics, flame-retardant materials, and defense applications, and its supply is limited and geopolitically sensitive. Early results from Zeus’s Casablanca antimony project are promising, with samples showing exceptionally high ore grades of up to 46.5% Sb.

With access to Newmont’s comprehensive database, Zeus can more effectively target high-potential zones, accelerating the discovery and development of new deposits in a country already recognized for its stable political climate, modernized mining framework, and skilled workforce.

Strategic choice of regions

The decision to concentrate on the Anti-Atlas and Central Meseta is deliberate. These regions are renowned for their mineral wealth, particularly gold and base metals, and are emerging as key sources of critical minerals for international markets. By focusing on these areas, Zeus seeks to position itself as a long-term player in Morocco’s rapidly developing mining sector.

Agreement terms and industry implications

The licensing deal includes a 1% net smelter return (NSR) royalty for Newmont on any project derived from the database, alongside a 15-year right of first refusal in case of future asset sales. This structure aligns the interests of both companies, promoting sustainable and profitable development while maintaining a stake for Newmont in potential discoveries.

Industry analysts note that Morocco’s appeal as a mining destination has grown in recent years, thanks to expanding infrastructure, a favorable regulatory environment, and a strategic location connecting Europe and Africa. For companies like Zeus, these conditions offer a stable platform for exploration and resource development, particularly for minerals essential to the energy transition and high-tech industries.

Long-term vision for Morocco

Zeus’s strategy extends beyond short-term exploration. By building a portfolio of high-quality assets in Morocco, the company seeks to establish a sustainable, long-term presence. The partnership with Newmont not only strengthens Zeus’s current operations but also enhances Morocco’s profile as a global hub for critical minerals, attracting further interest from international investors.

As the world faces growing demand for strategic resources, partnerships like that between Zeus and Newmont illustrate Morocco’s potential to play a central role in securing reliable mineral supply chains. For Zeus, the deal represents both a strategic entry point and a growth catalyst, enabling the company to advance rapidly in one of the most promising mining regions of North Africa.