Casablanca – Morocco continues to solidify its standing as one of the world’s key players in the fertilizer industry, maintaining its position among the top five global exporters in 2024. According to international trade data compiled by the Russian news agency RIA Novosti and based on both UN and national sources, Morocco ranked fifth worldwide in fertilizer exports, generating revenues of approximately $5.2 billion last year.

Despite a slight decline compared to the $5.45 billion recorded in 2023, Morocco’s performance remains significant in the context of an increasingly competitive global market. The Kingdom’s consistent presence among the top exporters highlights the strength of its fertilizer sector and its critical role in global food supply chains.

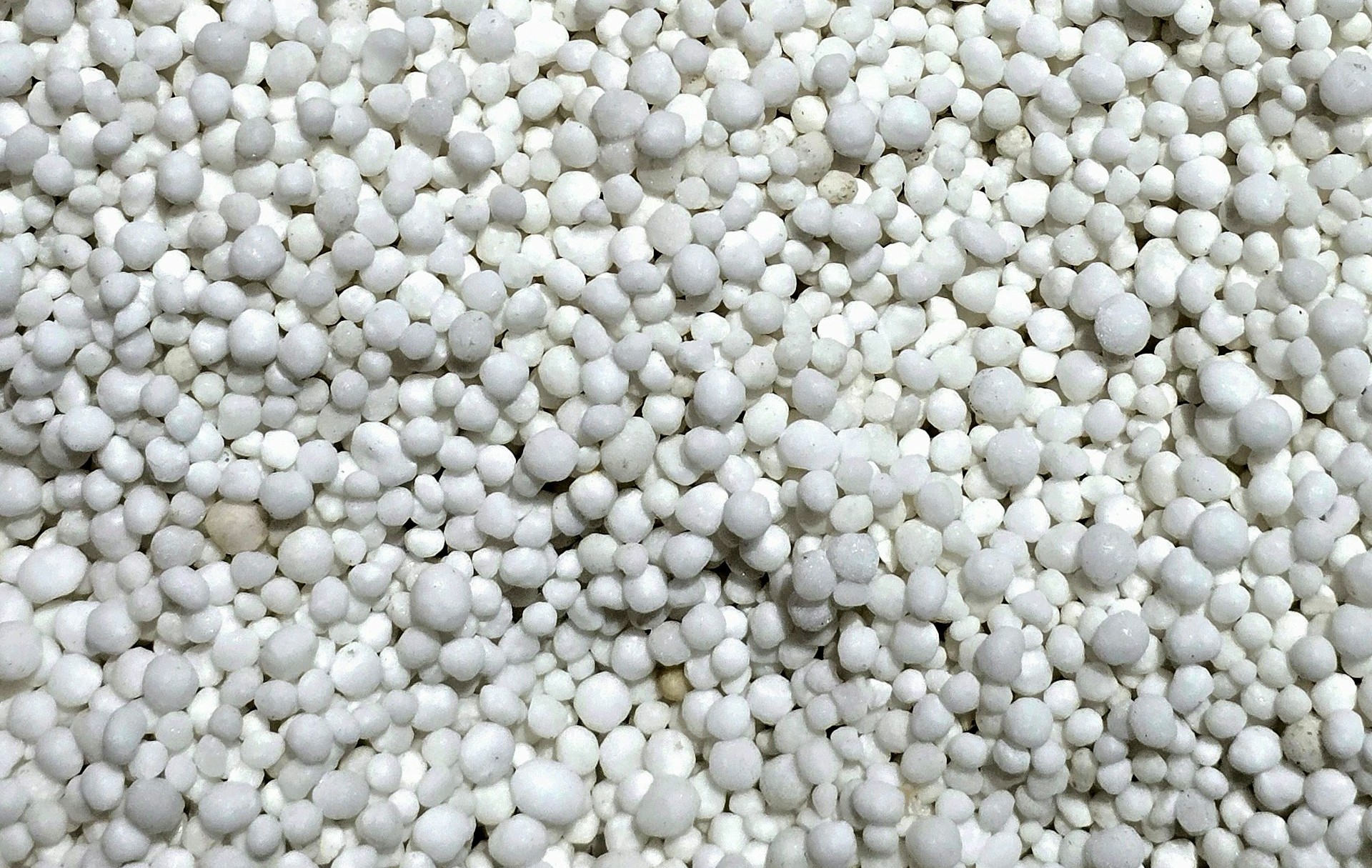

Leveraging abundant phosphate reserves

Morocco’s prominence in the fertilizer sector is largely rooted in its vast phosphate reserves—the largest in the world. The country has capitalized on this strategic natural resource through sustained investment in extraction and processing infrastructure. Central to this effort is the OCP Group (Office Chérifien des Phosphates), a state-owned enterprise and one of the largest producers of phosphate-based fertilizers globally.

OCP has been expanding its production capacity and investing in innovation and sustainability, positioning Morocco not only as a leading exporter but also as a reliable supplier in an increasingly uncertain global market. This industrial backbone has allowed Morocco to serve diverse markets and play a growing role in supporting agricultural productivity, particularly across Africa.

Morocco in the global fertilizer landscape

In 2024, Russia retained the top spot in global fertilizer exports with over $13 billion in revenues, representing more than 22% of the global market. China followed in second place, although it saw a drop from $9.7 billion in 2023 to $8.5 billion last year, capturing about 14% of the market. Canada ranked third with $6.7 billion, and the European Union placed fourth with $6.6 billion, despite a 6% decline in sales.

Morocco, in fifth place, outperformed several other major exporters such as the United States ($5.17 billion) and Saudi Arabia ($5 billion). Egypt, Israel, and Malaysia also featured among the top ten but with significantly lower export values, with Malaysia’s exports reaching around $823 million.

This ranking underscores Morocco’s status as a reliable and scalable supplier, particularly at a time when geopolitical tensions and trade barriers are reshaping global supply chains.

EU trade measures and market shifts

One of the major developments in 2024 affecting the fertilizer market was the European Union’s decision to impose new protective tariffs on imports of fertilizers and agricultural products from Russia and Belarus. This move, approved by the European Parliament and pending final ratification by the Council of the EU, reflects growing concerns over market dependency and price volatility.

However, the tariffs have sparked opposition from European farmers, who fear that such measures could drive up the cost of essential goods. Interestingly, the EU remains a net importer of fertilizers, with its imports exceeding exports by $300 million last year. This trade imbalance opens new opportunities for suppliers like Morocco, which can offer stable and competitive alternatives amid shifting market dynamics.

A strategic role in global food security

Beyond economic figures, Morocco’s fertilizer industry is increasingly viewed through the lens of global food security. With global populations rising and arable land facing climate-related pressures, fertilizer access is crucial to sustaining agricultural yields.

Through OCP’s Africa-focused initiatives and strategic partnerships, Morocco has positioned itself as a development partner on the continent, helping to boost local production capacities and improve soil health. These efforts align with broader goals of South-South cooperation and sustainable development.

Outlook and future prospects

As global demand for fertilizers continues to rise—especially in emerging economies—Morocco is well-positioned to not only sustain but also expand its role in the international market. Continued investment in production infrastructure, supply chain logistics, and high-value processing will be essential to driving this growth.

Backed by a clear national vision that harnesses the country’s vast phosphate reserves, advanced industrial base, and a network of global partnerships, Morocco is moving beyond being a major exporter—it is actively shaping the future landscape of the global fertilizer industry.