Casablanca – Morocco has consolidated its place among the ten leading African destinations for foreign direct investment (FDI), reflecting renewed investor confidence in its economy and the resilience of its industrial and energy strategies. According to the World Investment Report 2025 by the United Nations Conference on Trade and Development (UNCTAD), the Kingdom attracted $1.64 billion in FDI inflows in 2024 — a 55% increase compared to 2023. Although this marks a strong recovery, Morocco still ranks tenth on the continent, behind countries such as Ghana, Senegal, and Namibia.

A diversified industrial base driving growth

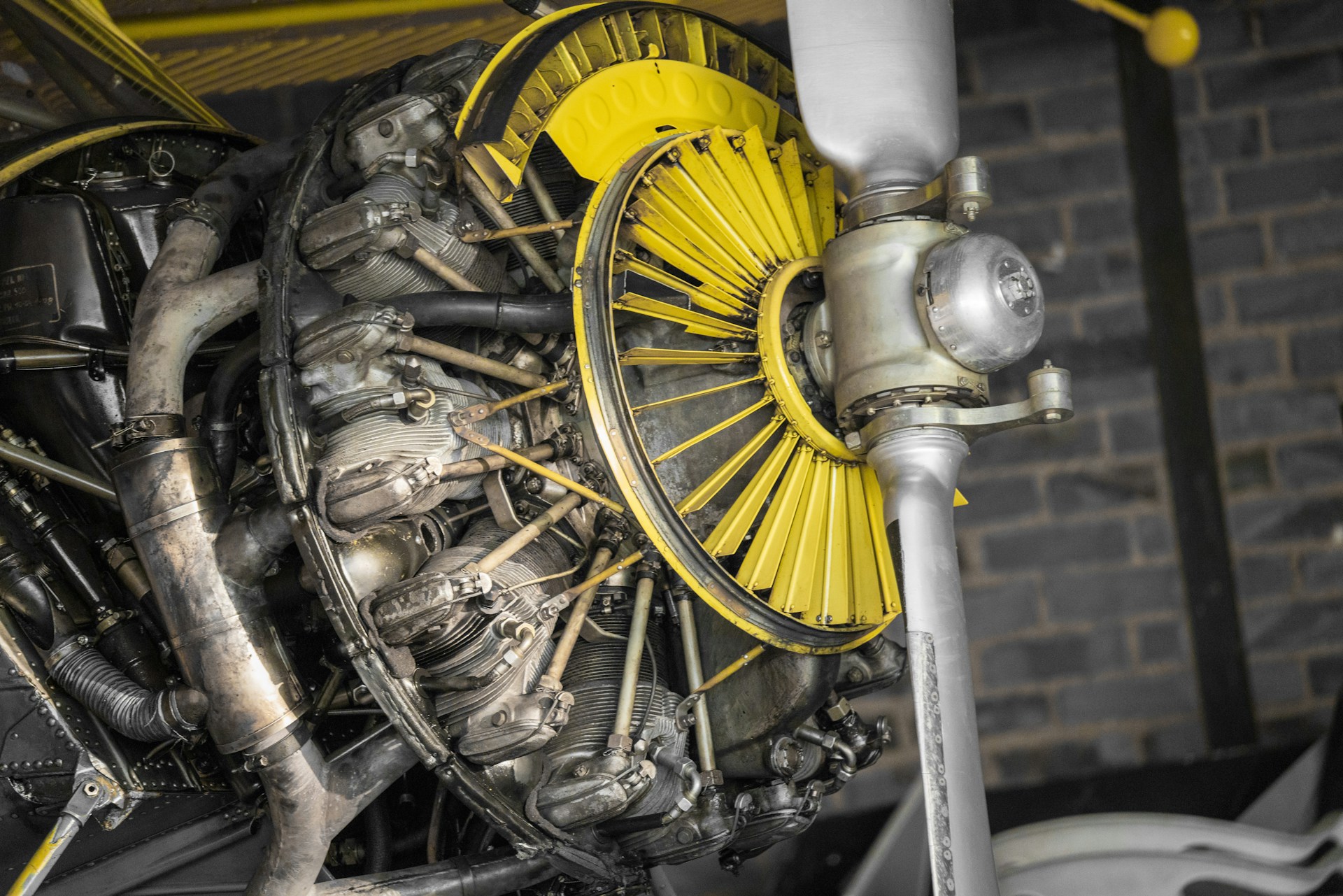

The growth in FDI reflects the continued diversification of Morocco’s industrial fabric, which has become a central pillar of its attractiveness. The country has established itself as a competitive regional manufacturing hub, particularly in the automotive, aeronautics, and electronics sectors. Leading global companies — including Renault, Stellantis, Lear, and Yazaki — have expanded operations in Morocco, benefiting from an advanced local ecosystem and modern infrastructure such as the free zones of Tanger Med and Kenitra.

The development of industrial platforms, logistics zones, and export-oriented clusters has strengthened Morocco’s position in regional and global value chains. The automotive industry remains a major contributor, with vehicle and component exports accounting for a significant share of industrial output. Meanwhile, the aeronautics and electronics sectors continue to grow, supported by partnerships with European and Asian suppliers.

Morocco’s geographic location remains a key advantage. Positioned at the crossroads of Europe, Africa, and the Middle East, the country enjoys privileged access to major markets through a network of free trade agreements with the European Union, the United States, and several African partners under the African Continental Free Trade Area (AfCFTA). These agreements reinforce Morocco’s role as a gateway for international investors seeking access to both African and European markets.

Renewables and green energy attract new capital

Beyond industry, Morocco’s national energy strategy has become another major driver of foreign investment. The country has emerged as a continental leader in renewable energy, particularly in solar, wind, and increasingly, green hydrogen.

Projects such as the Noor Midelt II solar complex and the expansion of the Tarfaya wind farm have attracted substantial financing from European and Gulf-based investors. The government’s goal of producing 52% of the country’s electricity from renewable sources by 2030 sends a strong signal to institutional and private investors alike. In addition, emerging hydrogen projects — seen as part of the global energy transition — are positioning Morocco as a future hub for low-carbon energy production in Africa.

This growing focus on sustainability is helping the Kingdom attract specialized funds dedicated to climate finance and infrastructure resilience. The country’s stability, coupled with its clear long-term energy roadmap, continues to differentiate it from other investment destinations on the continent.

Challenges remain despite progress

While the upward trend in FDI is encouraging, Morocco’s inflows remain below the record levels seen in the early 2010s, when they exceeded $3 billion annually. Experts note that much of the current improvement reflects recovery rather than a new cycle of sustained growth.

One persistent challenge is the geographic concentration of investments along the Casablanca–Tangier–Kenitra corridor. This industrial axis continues to attract most projects, leaving several inland regions with high potential still underdeveloped. Strengthening infrastructure and connectivity in these areas remains essential for achieving a more balanced territorial distribution of investment.

In addition, international investors continue to call for greater regulatory clarity and administrative efficiency. Simplifying procedures, ensuring transparent public tenders, and reinforcing property-rights protection are seen as crucial steps to improve Morocco’s investment climate.

The country also faces the task of accelerating innovation and digital transformation. Despite progress in recent years, Morocco’s technology ecosystem remains modest compared to global benchmarks. To attract future-oriented investment, experts suggest prioritizing digital skills development, applied research, and support for start-ups in high-tech and green industries.

Africa’s investment landscape in 2024

Across Africa, total FDI inflows reached a record $97 billion in 2024 — a 75% increase year-on-year, according to UNCTAD. This surge was largely driven by major projects in Egypt, Côte d’Ivoire, and Mozambique. Egypt topped the continental ranking with $46.58 billion in FDI, largely attributed to the massive Ras El-Hekma urban development project financed by the Emirati sovereign wealth fund ADQ.

Côte d’Ivoire ranked second with $3.8 billion, followed by Mozambique ($3.55 billion), Uganda ($3.31 billion), and the Democratic Republic of Congo ($3.11 billion). South Africa ranked sixth with $2.48 billion, ahead of Namibia ($2.06 billion), Senegal ($2.02 billion), Ghana ($1.67 billion), and Morocco, which closed the top ten with $1.64 billion.

Despite its position at the bottom of the top 10, Morocco was one of the countries with the fastest growth rate, outperforming several peers in relative terms.

Outlook: Converting recovery into long-term momentum

Morocco’s renewed attractiveness signals the resilience of its economic model and the confidence of international markets in its long-term prospects. However, sustaining this momentum will require deepening structural reforms, strengthening regional integration, and fostering innovation.

The government’s continued investment in renewable energy, port infrastructure, and digital connectivity could further enhance Morocco’s competitiveness. Expected future investments in green hydrogen, electric mobility, and industrial modernization may allow the Kingdom to climb higher in Africa’s FDI rankings in the coming years.

In an increasingly competitive African investment landscape, Morocco’s path forward will depend on its ability to combine industrial growth with sustainability, innovation, and balanced regional development. By maintaining its current trajectory and deepening reforms, the country has the potential to transform its recent rebound into a lasting foundation for inclusive and sustainable growth.