Casablanca – Morocco’s productive sector continues to show gradual signs of recovery, supported by rising business creation, improving exports, and accelerating value added. However, the latest findings from the 2025 annual report of the Moroccan Observatory for Very Small, Small, and Medium Enterprises (OMTPME) indicate that this progress remains uneven and structurally fragile. While macroeconomic indicators suggest a phase of consolidation after successive shocks, deep-rooted imbalances persist across company size, regional distribution, access to finance, and gender inclusion.

Business creation accelerates, but vulnerability remains high

In 2024, Morocco recorded 380,230 active incorporated companies, representing a year-on-year increase of 1.3 percent. This expansion was driven by strong entrepreneurial momentum, with nearly 96,000 new businesses created during the year, more than two-thirds of them incorporated entities. These figures confirm the continued attractiveness of entrepreneurship and a gradual normalization of economic activity following the post-pandemic period.

However, this positive trend is accompanied by persistent fragility. Business dissolutions rose by 6.3 percent, affecting more than 11,500 companies. More than half of the firms that ceased operations were less than five years old, highlighting the vulnerability of young enterprises during their early consolidation phase. Very small businesses, often undercapitalized and highly exposed to market volatility, remain particularly at risk.

Micro-enterprises continue to dominate Morocco’s entrepreneurial landscape, accounting for 86.6 percent of incorporated companies. In addition, 94 percent of firms report annual turnover below approximately $1.03 million, while small and medium-sized enterprises in the strict sense represent only 5.5 percent of the total. This structure reflects a productive fabric characterized by a broad base of small operators and a limited middle segment capable of scaling up.

Strong geographic and sectoral concentration

Territorial disparities remain a defining feature of the Moroccan economy. Nearly 65 percent of companies are concentrated along the Tangier–El Jadida corridor, with the Casablanca-Settat region alone hosting 38 percent of all firms. This concentration reinforces regional inequalities and limits the diffusion of economic activity to other parts of the country, despite ongoing public initiatives aimed at promoting territorial balance.

From a sectoral standpoint, trade remains the most represented activity in eight of Morocco’s twelve regions, followed by construction. While these sectors play an important role in employment and local economic dynamics, manufacturing—despite its strategic importance for value added and exports—accounts for a relatively limited number of firms. This imbalance highlights the challenge of strengthening Morocco’s industrial base beyond a narrow set of activities.

Growth largely driven by large enterprises

Economic growth accelerated in 2024, with total turnover generated by incorporated companies reaching approximately $271.96 billion, reflecting a year-on-year increase of 9.4 percent. Value added expanded even more rapidly, rising by 16.6 percent to about $55.31 billion. These results point to post-crisis consolidation and improved performance across several sectors.

However, this growth remains highly concentrated. Large enterprises, which represent just 0.5 percent of all companies, generated nearly two-thirds of total turnover and value added. Without their contribution, value-added growth would have been limited to around 8 percent. This concentration underscores the dual nature of the Moroccan economic model, in which a small number of large players drive overall performance, while the majority of firms operate with limited margins and restricted growth potential.

Sectoral dynamics further illustrate these contrasts. The electricity and gas sector recorded exceptional growth exceeding 80 percent, while extractive industries experienced a decline. Manufacturing, trade, and construction remained the main contributors to value added, with certain industrial segments showing gradual signs of upgrading.

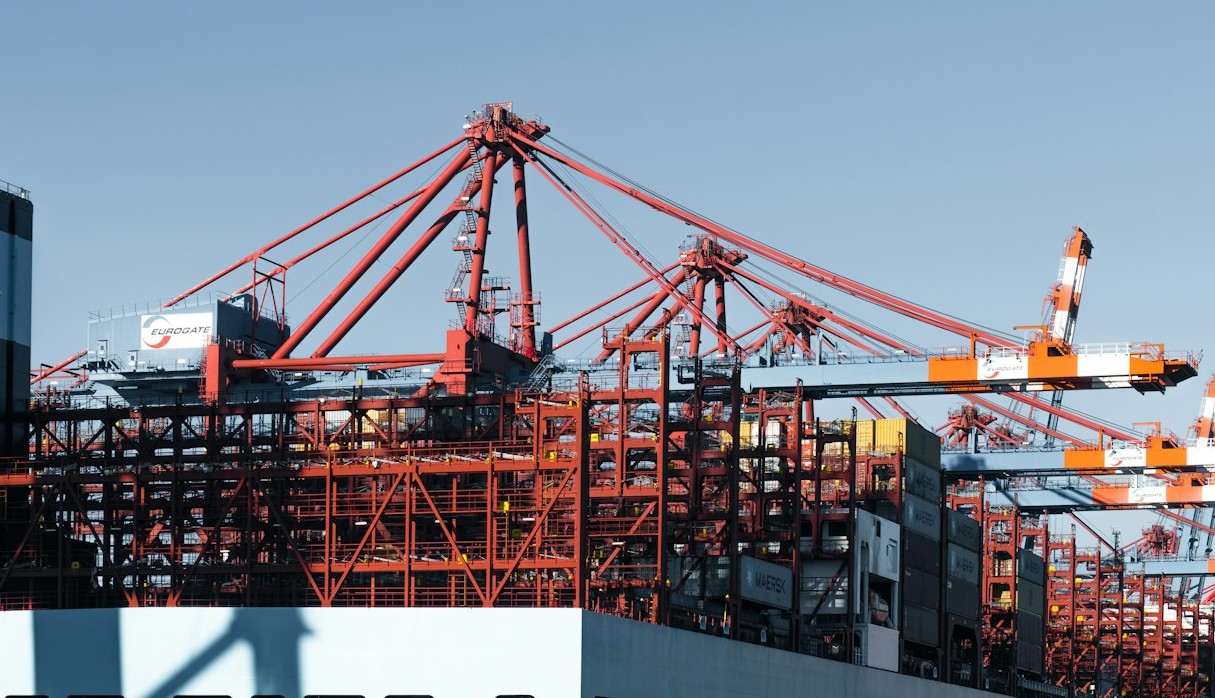

Exports recover, but gains remain concentrated

After slowing in 2023, Moroccan exports rebounded strongly in 2024, increasing by 12.7 percent to reach approximately $53.66 billion. Manufacturing accounted for more than half of export revenues, driven primarily by the automotive and electrical industries, which continue to anchor Morocco’s integration into global value chains.

Despite this recovery, export activity remains highly concentrated both sectorally and geographically. Very small enterprises and young firms continue to play a limited role in international markets, reflecting ongoing barriers related to scale, access to finance, and competitiveness.

Employment growth faces quality and equity challenges

Formal employment continued to expand at a moderate pace, with the number of workers registered with the national social security system exceeding 4 million, an annual increase of 2 percent. Very small, small, and medium enterprises remain the backbone of job creation, accounting for more than 70 percent of formal employment.

The total wage bill rose by 8.6 percent, suggesting some improvement in income levels. However, wage distribution remains uneven. More than 70 percent of employees earn less than approximately $412 per month, and nearly half receive wages equal to or below the minimum salary. Women remain disproportionately represented in lower wage brackets, underscoring persistent gender inequalities in the labor market.

Financing constraints and gender gaps persist

Access to finance continues to be a major constraint for small businesses. Of the approximately $65.01 billion in outstanding bank credit, 60 percent is allocated to large enterprises, while very small enterprises receive only 20 percent. Micro-enterprises, often excluded from traditional bank financing, rely heavily on shareholder loans, which account for more than 40 percent of their liabilities.

Gender disparities further compound these challenges. Women-led businesses represent just 15.5 percent of all enterprises and receive only around 11 percent of total bank credit. Although the number of businesses created by women has increased, their concentration in social and personal service sectors, combined with limited access to financing, continues to constrain growth prospects.

Toward a more inclusive and balanced economic model

The OMTPME’s 2025 report confirms that Morocco has entered a phase of economic consolidation, supported by stronger growth indicators and a recovery in exports. However, the persistence of structural imbalances—between large and small firms, regions, and genders—suggests that recovery alone is insufficient to ensure inclusive and sustainable development.

Addressing these challenges will require targeted public policies aimed at improving business survival rates, expanding access to financing for very small and young enterprises, supporting women entrepreneurs, and reducing territorial disparities. As Morocco seeks to strengthen its productive base and economic resilience, the performance of its VSMEs will remain a key indicator of the country’s broader economic transformation.