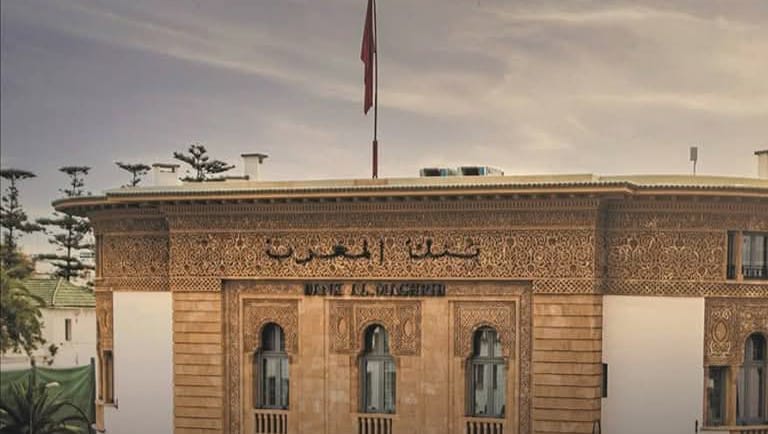

Casablanca – Bank Al-Maghrib (BAM), Morocco’s central bank, is set to make a pivotal move in transforming the country’s financial landscape with the upcoming launch of a dedicated FinTech hub. Slated for January 2025, the initiative aims to accelerate the adoption of innovative financial technologies and foster financial inclusion across Morocco.

A new era for financial innovation in Morocco

The FinTech hub will serve as a central platform uniting various players within Morocco’s financial ecosystem. With a focus on innovation, the hub will provide a structured framework designed to support the development of financial technologies tailored to the unique needs of the Moroccan market. Key areas of focus include blockchain technology, digital payment systems, and the application of artificial intelligence to enhance banking services.

Abderrahim Bouazza, Director General of Bank Al-Maghrib, explained that the initiative would offer personalized guidance and financial support to entrepreneurs and companies working on disruptive technologies in the financial sector. By aligning with international best practices, BAM aims to position Morocco as a leading force in the digital financial revolution across Africa.

Empowering small and medium-sized enterprises (SMEs)

In addition to driving digital innovation, the FinTech hub is expected to play a crucial role in empowering Morocco’s small and medium-sized enterprises (SMEs), which represent a vital component of the country’s economy. SMEs account for 40% to 45% of all bank loans in Morocco, underscoring their importance as engines of economic growth and employment.

Through the hub, BAM aims to further support SMEs by providing access to innovative financial tools and technologies that can help them overcome challenges such as limited access to credit. The initiative aligns with Morocco’s broader economic goals of improving transparency and reducing risks for both businesses and banks.

Improving access to data and financial resources

A key part of the initiative is the development of modern data platforms and credit bureaus, which will help increase the accessibility of reliable and centralized information. By facilitating easier access to data, the FinTech hub will enable banks to make better-informed lending decisions, improving SME access to financing.

According to Bouazza, the availability of trustworthy, easily accessible information is essential to building trust in the financial system and ensuring greater access to credit for businesses across Morocco.

Towards a resilient and competitive financial system

The launch of the FinTech hub is part of Bank Al-Maghrib’s broader strategy to accelerate the digital transition in Morocco and create a more resilient and competitive financial system. Through the integration of innovative technologies, the central bank hopes to strengthen Morocco’s position as a leader in the African financial sector.

By encouraging financial inclusion and supporting SMEs, the FinTech hub will help Morocco tackle future economic challenges and create new opportunities for entrepreneurs and investors alike. This step positions the country as a regional pioneer in the FinTech space, with the potential to attract both local and international interest in its rapidly evolving market.