Casablanca – Morocco’s banking sector remained a pillar of economic stability in 2024, demonstrating strong asset growth, expanding credit activity, and steady performance indicators. However, the sector continues to face challenges including high concentration among a few major banks and a growing burden of household debt. These insights are drawn from the 12th annual Financial Stability Report published jointly by Bank Al-Maghrib (BAM), the Insurance and Social Welfare Supervisory Authority (ACAPS), and the Moroccan Capital Markets Authority (AMMC).

Market dominance of three major banks

The sector remains highly concentrated, with just three banking groups—all privately owned and majority Moroccan in capital—controlling the lion’s share of financial activity. In 2024, these three institutions held:

- 60.7% of total banking assets

- 61.6% of net loans

- 62.7% of total deposits

These proportions are unchanged from 2023, reflecting the entrenched position of these institutions in the Moroccan financial system. Domestically, they operated a network of 2,955 branches, while their international reach extended through 51 subsidiaries and 22 representative offices.

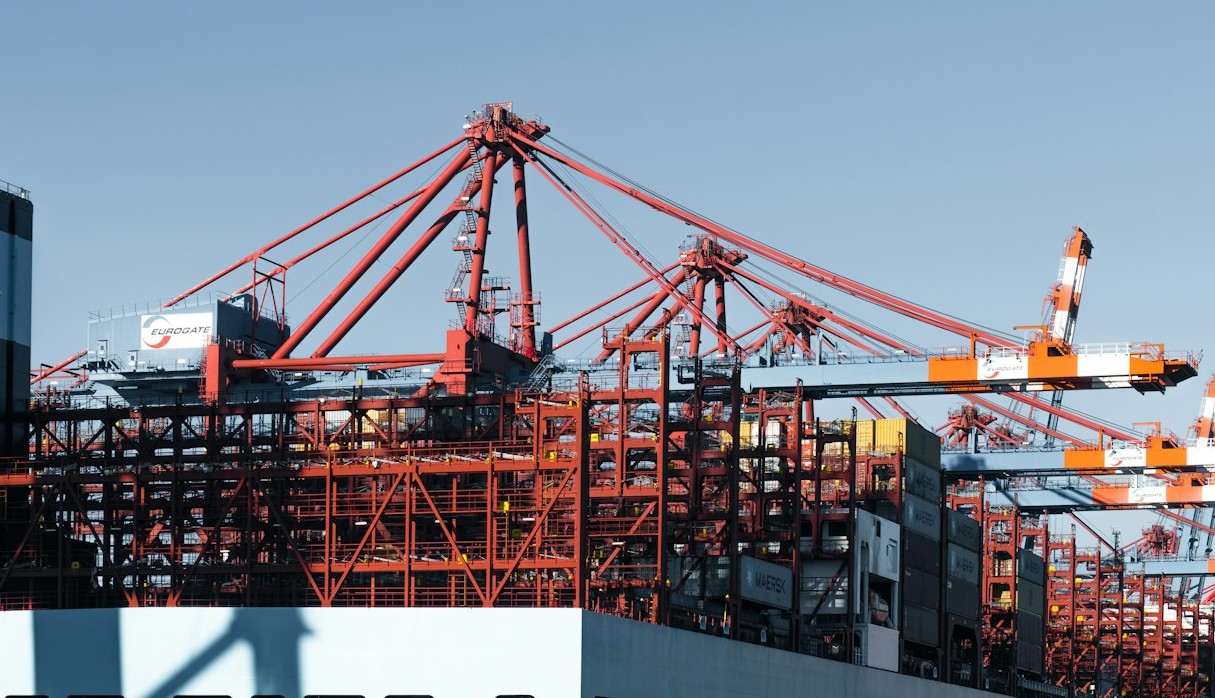

Total banking assets and credit expansion

The total assets of the Moroccan banking sector rose to approximately $221 billion in 2024, an 8.3% increase compared to 2023, which had recorded a 4.2% rise. This growth was mainly driven by a rebound in market activities and, to a lesser extent, an increase in lending.

Banking assets remained equivalent to 134% of Morocco’s GDP, underlining the sector’s central role in the national economy.

Sectoral breakdown of loans

The report underscores that banks continue to distribute credit across various sectors, although households emerged as the largest borrower group, holding 30% of all loans by the end of 2024.

Key sectoral loan allocations include:

- Financial services: $21.75 billion (18%)

- Other services: $11.96 billion (10%)

- Manufacturing industries: $10.42 billion (8.7%)

- Construction and public works: $9.9 billion (8.2%)

- Trade: 6.8%

- Energy and water: 6.2%

- Transport and telecom: 3.6%

- Extractive industries: 3.3%

Despite diversification, the sector also saw a notable increase in lending concentration. Loans to large borrowers grew by 3.8%, reaching $55.3 billion. The top five borrowing groups held 35.4% of this total, while the top ten accounted for 51%, indicating relatively high exposure to a few major clients.

Rising household debt

A key development in 2024 was the continued rise in household debt, which reached approximately $44 billion, up 3.8% from the previous year. Of this total, around $41.75 billion was owed by residents, while debt held by Moroccans living abroad rose by 2.7%.

Banks were the source of around 80% of these household debts, split into:

- Housing loans: 62%

- Consumer loans: 38%

The housing loan segment grew modestly by 1.5%, though Islamic (Murabaha) home financing surged by 16%, reaching new levels of demand for Sharia-compliant products. Fixed-rate housing loans remained dominant, with interest rates between 4% and 6%, providing borrowers some protection from market fluctuations.

Government-backed housing loans, which had been declining in previous years, decreased by only 1.3% in 2024. These loans amounted to $4.18 billion, representing 15% of all housing loans.

Growth in participatory finance

Participatory finance, or Islamic banking, continues to expand. In 2024, Sharia-compliant lending grew by 19%, reaching around $4.02 billion, up from $3.37 billion the previous year. This growth reflects a steady increase in public demand for alternatives to conventional banking, especially for housing.

Stability with strategic risks

Despite the challenges, the Moroccan banking sector showed resilience, supported by solid indicators in liquidity, profitability, and capital adequacy. The loan concentration index rose slightly to 0.142 from 0.136 in 2023, still within safe levels but highlighting the need for vigilance in credit exposure.

The continued dominance of a few banking groups, coupled with increasing household debt and rising exposure to major borrowers, suggests the need for careful regulation and diversified financial strategies.

Outlook

Looking ahead, maintaining financial inclusion and improving access to affordable credit—particularly for small businesses and low-income households—will be critical. As Morocco’s banking system grows in size and complexity, a balance between performance, oversight, and equitable credit distribution will be essential to ensure long-term stability and inclusive economic development.