Casablanca – Morocco is fast emerging as a key player in the global aerospace industry, with the government announcing plans to expand the sector’s capabilities from components manufacturing to full aircraft assembly over the next decade.

At the Paris Air Show this week, Minister of Industry and Trade Ryad Mezzour revealed that 150 aerospace companies now operate at least one facility in Morocco, generating a combined annual revenue of approximately $2.7 billion. These firms include major international players such as Boeing, Airbus, and Safran.

According to Mezzour, these companies focus primarily on airframe manufacturing, structural components, aircraft interiors, and wiring systems. Their operations are concentrated around the cities of Casablanca, Tangier, Rabat, and Fez, and together they provide 26,000 full-time jobs.

Workforce and cost competitiveness

One of Morocco’s major strengths in the aerospace sector is its growing pool of technical talent. The country trains 23,000 engineers annually, with approximately 400 entering the aerospace industry each year. This talent pipeline, combined with competitive labor costs—around $27 per hour, compared to $108 to $130 per hour in Europe or the U.S.—has helped the country attract sustained foreign investment.

“We have the necessary infrastructure, human capital, and cost advantages to play a more significant role in the global aerospace value chain,” said Mezzour. “Our aim is to move beyond component manufacturing and gradually expand toward more complex operations such as cabin fitting, landing gear production, and eventually, final aircraft assembly.”

Growing international partnerships

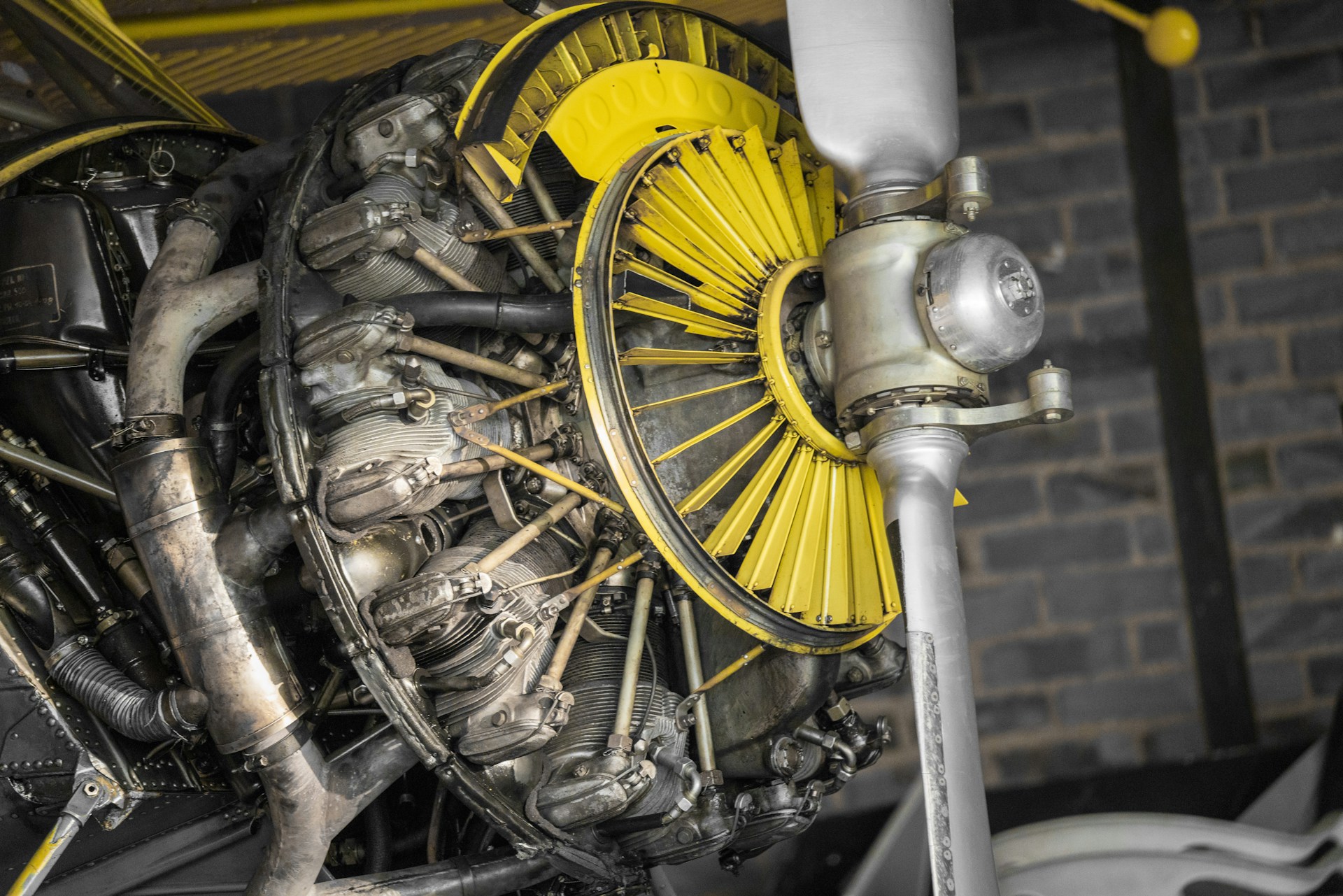

In recent years, Morocco has deepened its cooperation with global aerospace firms. During French President Emmanuel Macron’s visit to Morocco in October 2024, an agreement was signed between Royal Air Maroc and French engine manufacturer Safran, extending their partnership to include the next-generation CFM Leap engines.

Royal Air Maroc is also considering an order of Airbus A220 aircraft, a narrow-body model well-suited for its European route network. A feasibility study is underway to support this decision as part of the national carrier’s fleet modernization strategy.

Boeing expands investment in Morocco

Among the most notable developments at this year’s air show was a new partnership agreement between Boeing and Casablanca Aéronautique, a Moroccan subsidiary of the French group Figeac Aero. The deal covers the production of machined structural parts for the 737 MAX program and signals Boeing’s intention to strengthen its industrial base in Morocco.

This partnership builds on the 2016 Memorandum of Understanding signed between Boeing and the Moroccan government, which laid the groundwork for the development of a comprehensive aerospace ecosystem in the country.

“The expansion of Boeing’s manufacturing footprint in Morocco is a testament to our reliability and our growing expertise in high-precision aerospace manufacturing,” said Mezzour. “It also reflects the country’s potential to integrate more deeply into global supply chains.”

Aiming for final assembly by 2035

Looking ahead, Morocco is setting its sights higher. The government plans to double the aerospace sector’s revenue to more than $5.4 billion by 2030. A central part of this vision is the establishment of a final assembly line for commercial aircraft, a milestone that would place Morocco in a select group of countries capable of producing complete airplanes.

“We believe that within the next 10 years, Morocco will be able to manufacture aircraft from start to finish,” said Mezzour. “This includes everything from structural production and systems integration to cabin assembly and landing gear manufacturing.”

Strategic vision

This aerospace push is part of a broader strategy to position Morocco as a regional and international industrial hub, as outlined in national industrial development plans and supported by the monarchy.

With political stability, competitive operating conditions, and growing technical capabilities, Morocco is increasingly being viewed as an attractive destination for aerospace investment—not only as a low-cost manufacturing location, but as a strategic partner for long-term growth.

As the global aviation industry looks to diversify its supply chains and reduce production costs, Morocco is stepping forward with a clear vision, growing expertise, and a track record of delivery.